As we know, in the lithium battery family, ternary lithium and lithium iron phosphate are the two mainstream lithium batteries of new energy at present. However, in the early stage of commercial application of lithium battery, the actual situation was not like this. The current pattern is a phased situation with the realization of commercial mass production of lithium battery, the changes brought by technological breakthroughs, and the increasing market has brought about the continuous iteration of lithium battery products. That’s because now far not reached the mature markets of new energy battery application pattern, as the market for different application requirements put forward by the lithium battery, and these requirements with the technology research and development progress, in the next few years may appear very different situation, we are now current technology situation, predictions about possible lithium battery application market in the next few years.

The rise of ternary lithium batteries

Akira Yoshino, one of the three winners of the 2019 Nobel Prize in Chemistry, discovered the positive material of lithium cobalate on the basis of previous works and transformed the anode of lithium-ion batteries, replacing the widely used lithium metal anode material with carbon anode material — graphite. Thus avoid the lithium dendrite generation of lithium battery in the use process of lithium battery internal short circuit caused by fire and other safety hazards. Therefore, SONY of Japan took the lead in realizing the commercial mass production of lithium ion battery, namely lithium cobaltate battery, and applied it in the field of 3C electronic products such as computer and mobile phone. Due to its small size, weight, large power, and environmental protection, with its large-scale commercialization, the cost is reduced. The application of ni-CR and ni-MH batteries in the field of 3C electronic products has also been gradually eliminated.

Due to various excellent characteristics of lithium-ion batteries, people gradually began to think of larger capacity lithium-ion batteries for larger electric energy needs, such as passenger cars. Keep in mind that a standard 4-seater passenger car requires about 5,000-7,000 times as many batteries as a standard cell phone battery. We can see that with the popularity of smart phones, super-large battery manufacturers such as Sunwoda and ATL (Amperex Technology Limited) were born just to be installed in the supply chain of Apple mobile phones. If power batteries can be supplied for passenger cars, it will be an unimaginable market.

In 2011, Zeng Yuqun, then ATL’s CEO, apparently thought so. Back in that year, BMW Brilliance went to TDK, the holding company of ATL, to seek cooperation in the research and development of lithium battery for vehicles, but was rejected by TDK coldly. Therefore, Zeng Yuqun led the R&D team of ATL to leave ATL and set up a new company– CATL. Determined to develop a new generation of power type large capacity lithium ion battery and into the supply chain of BMW new energy passenger cars. At that time, CATL bet on ternary lithium battery, because ternary lithium battery is the highest energy density, the best power performance of all the lithium battery series, the most suitable for the power of passenger car lithium ion battery. In fact, we have to admire Zeng Yuqun who regards “stronger bet” as his life motto. With the huge explosion of China’s electric passenger car market in 2016 and the national subsidy policy based on the energy density of lithium batteries, CATL has successfully become the largest enterprise in the world in terms of installed capacity of lithium batteries. CATL was only five years old. Since 2016, CATL has ranked first in the world in terms of global lithium battery manufacturer until now. In 2021, CATL’s global market share of lithium battery is as high as 32.6%, far higher than LG of South Korea, Samsung and Panasonic of Japan. Ternary lithium looks to be the clear leader in the lithium-ion battery family until at least 2020, crushing the second best lithium iron phosphate. Every coin has two sides. The other side of ternary lithium’s ultra-high energy density is its unstable electrochemical structure, which is prone to internal short circuit, resulting in combustion and explosion. As long as such problems are not solved, the status of ternary lithium can never be stable.

Lithium iron phosphate strikes back

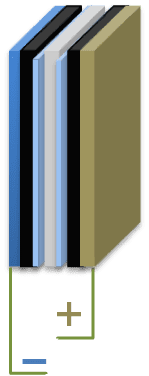

First of all, let us make a brief review of the advantages and disadvantages of lithium iron phosphate and high nickel ternary. Ternary high energy density batteries, has a wide temperature range, the dynamic performance is excellent, and the voltage of its single cell(3.7V) higher than lithium iron phosphate cell(3.2V), then it can be designed when making battery pack less string of number, but the cost is higher, safety performance is low, there are risks of burning improper use, Cycle life performance is also low; Lithium iron phosphate is superior to ternary battery in cost, safety performance and service life, but the low voltage of single cell and low group energy density make it limited in high demand applications.

In October 2021, Daimler group said that its Mercedes-Benz will switch to the use of cheaper but lower power lithium iron phosphate batteries, this news made the lithium iron phosphate has become the focus of the industry, actually before the Chinese government new energy subsidy policy, these two lithium batteries shared the world, each has its own advantages. However, under the influence of energy density and range as the main indicators of the subsidy policy, Ternary occupies the majority of the market share. With the removal of the subsidy policy, the cost advantage of lithium iron phosphate is reflected in the market at the first time, and its high safety performance is also the preferred option of consumers.

According to statistics from The China Automotive Power Battery Industry Innovation Alliance, the installed volume of lithium iron phosphate surpassed ternary batteries for the first time in July 2021. In September, the installed capacity of power battery reached 15.7GWh, up 138.6% year on year, among which the installed capacity of lithium iron phosphate was 9.5GWh, up 309.3% year on year. Firstly, the continuous explosion of lithium iron phosphate is inseparable from the hot sales of BYD, Wuling Hongguang Mini EV and other popular vehicles. Meanwhile, Tesla also announced that it is equipped with CATL’s lithium iron phosphate batteries. It is expected that the lithium iron phosphate market will continue to open high in the case of major car manufacturers, followed by the shortage of market materials and so on will also be expected to achieve.

From the technical level, the return of lithium iron phosphate is also benefited from the backward renovation of battery pack technology, such as TESLA’S CTC, CATL’S CTP, BYD’s blade battery, CALB’s one-stop-battery, GAC’s magazine battery system, Great Wall Motor’s Dayu battery system and so on. As a result, the energy density of the LFP pack is greatly improved, and the lithium iron phosphate battery can also reach the range of more than 500 km or even higher, so it has become the ideal choice for users under the condition of reducing the anxiety of running, with the advantages of cost and safety performance.

In addition, in 5G the general construction, the development of the electric marine, reducing carbon policies, all kinds of household and industrial use energy storage system under the preparation of the future development,which looks all making LFP batteries future very brilliant, after all, the use of scene is not high energy density must demand, cost and safety is the primary consideration, The resurgence of lithium iron phosphate is an inevitable trend from the phenomenon of the fast expansion of leading material factories.

Whose world is the future? Solid-state batteries or sodium-ion batteries?

Looks like lithium iron phosphate is going to dominate the market again, but such a king status is not safe, the future is full of changes! There are new materials and technologies on the horizon, such as sodium-ion batteries, solid-state batteries, pluralist batteries and hydrogen.

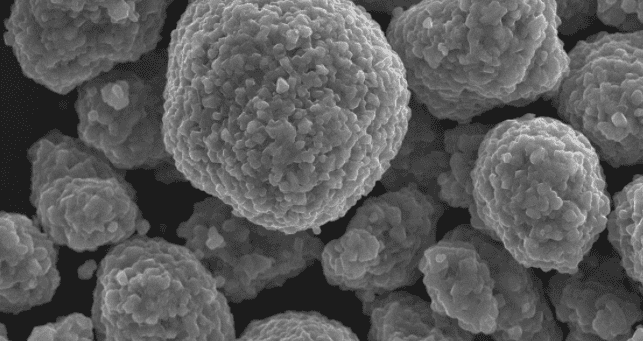

CATL released sodium ion battery in July 2021, which made the market crazy for a while, and all kinds of enterprises related to it have become the focus of the market. The main electrode material used in sodium-ion batteries is sodium salt, which is much more abundant and cheaper than lithium salt. Because sodium ions are larger than lithium ions, sodium-ion batteries are a cost-effective alternative when weight and energy density are not critical. Compared with lithium ion battery, sodium ion battery has the following advantages :

(1) sodium salt raw materials are abundant and cheap. Compared with ternary cathode materials, the raw material cost is reduced by half.

(2) Due to the characteristics of sodium salt, allow the use of low concentration electrolyte (electrolyte with the same concentration, sodium salt conductivity is about 20% higher than lithium electrolyte) to reduce costs;

(3) Sodium ion does not form alloy with aluminum, aluminum foil can be used as a collector in the negative electrode, which can further reduce the cost of about 8%, reduce the weight of about 10%;

(4) The sodium ion battery is allowed to discharge to zero volt due to its non-over-discharge characteristics. Sodium-ion batteries have an energy density of more than 100Wh/kg, which is comparable to lithium iron phosphate batteries, but with significant cost advantages, they are expected to be used in large-scale energy storage.

In addition, because the commercial production line of sodium positive materials is basically the same as lithium iron phosphate, the technological reserve of Nasicon series solid electrolytes developed by CeramiX is naturally compatible with sodium ions and can be applied to the production of sodium positive materials without any difficulties. At present, the only difficulty in the core material of sodium ion battery is the conversion of electrolyte from lithium hexafluorophosphate to sodium hexafluorophosphate. Therefore, it can be foreseen that the commercial mass production of sodium ion battery may be in the next 3 years, which will be a blow to lithium iron phosphate. However, the commercial mass production of sodium ion battery does not mean that the cost advantage will appear immediately. It may take 5-6 years of full competition and time verification for sodium ion battery to truly realize the huge advantage of battery performance comparable to lithium iron phosphate and cost lower than lithium iron phosphate.

Plus, the consensus within the industry is that the next generation of lithium batteries, solid-state batteries, will be the ultimate route for power batteries. We know that the most fundamental reason for the insecurity of lithium batteries is that the electrolyte is flammable, and the ignition temperature of the electrolyte is about 150℃. The Nasicon series of solid electrolytes from CeramiX, for example, can have a ignition point of up to 1000℃. Therefore, solid state batteries can be safe and reliable. It is foreseeable that the material selection end must be ternary material with high energy density, which is likely to be a huge blow to lithium iron phosphate.

Of course, these technologies have not reached the extent of actual mass production, and the final market also needs maybe 5-10 years to totally accept the new generation battery . However, at least before the new technology comes out, it can be foreseen that lithium iron phosphate will dominate the market again.